Florida homeowners insurance rates are increasing. The rates have risen by 33% since 2016. However, rates can differ from one county to another. To avoid paying a higher premium, consider taking advantage of discounts for adding certain protective devices to your home. Flood damage is one the most common claims in Florida.

Since 2016, rates have increased by 33%

Florida is witnessing a surge in homeowners' insurance rates. According to the Insurance Information Institute, Florida's property insurance rates have increased an average 33% per year since 2016. This is higher than the 10.9% average national increase. The increase in Florida insurance rates is not caused solely by this. In-state small insurers are struggling to compete in the state. Sixteen Florida-based insurance companies declared bankrupt this year.

Insurance costs are on the rise partly because of an increase storms which have led to an increased in reinsurance. Some reinsurers are withdrawing from Florida while others raise rates. Those costs are passed on to consumers, who pay between 35% and 50% of the premium.

Florida flood damage is a very common claim.

In case of flooding, you should seek flood damage coverage on your homeowner's insurance policy. Florida is well-known as a place where severe weather can occur. Therefore, it's crucial to ensure your policy covers any potential damage. Floods can cause significant damage to your property and can be expensive to repair.

Flood damage can cause thousands of dollars of damages, including mold and structural damage. Homeowners are faced with the unfortunate reality of water damage, no matter if it was due to a hurricane. Florida homeowners insurance provides flood coverage. Flood damage could also result from flooding caused by mudflows. Flood damage can be as little as one inch in your home.

Florida offers liability coverage as part of its home insurance.

Liability coverage can be an important part homeowners insurance. Liability coverage covers medical expenses incurred due to injury to another person. It also covers other possible expenses that could arise due to negligence. To cover the costs of negligence lawsuits, you will need adequate liability coverage. It is a good idea to hire an agent who has experience in reviewing policies and ensuring you get the best rates.

Florida home insurance also includes liability coverage. The coverage amount will depend on the type, age and contents of your home. A separate policy will be required if you own a detached garage. Typically, the limits for these structures are 2% or 10% of the amount of coverage on the main dwelling. If you want to purchase greater limits, you can. Your agent should be informed if your detached structure is rented out or used for business purposes. You may need specialized coverage for these situations.

Protective devices can be added to your home at a discounted price

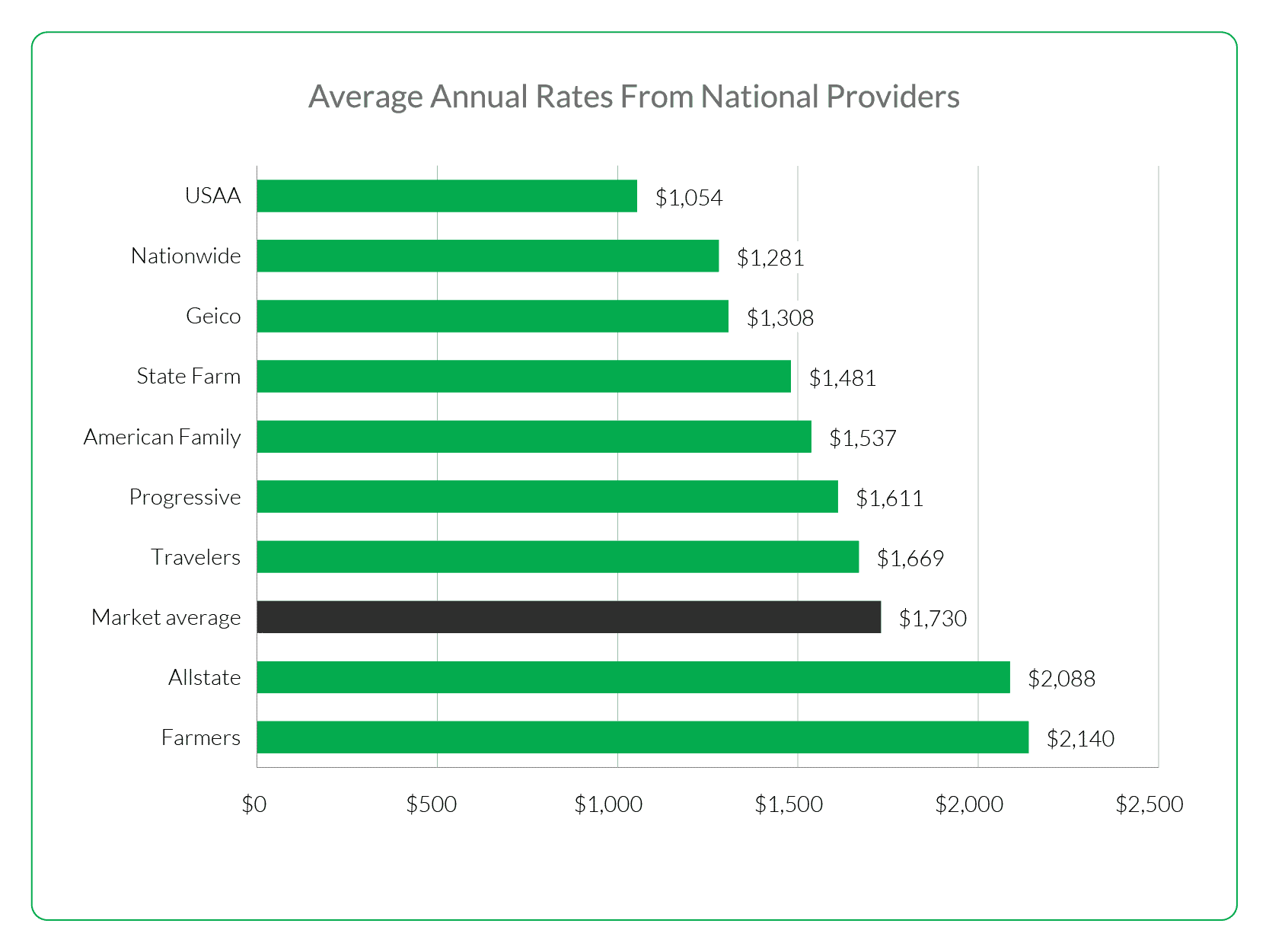

Many insurance companies offer discounts for homeowners who add protective devices to their homes. This includes smart home technology. Farmers, Liberty Mutual, USAA, and USAA offer discounts to homeowners who add ADT security system. The qualifications for each state may differ. These discounts can help reduce the total cost of smart-home upgrades and offer an incentive to create safer homes.

Smart home technology is not the only way to protect your house. You could install an alarm or smoke detector. These devices can help you protect your home against fire and theft. They can also reduce your property insurance premiums.