Ohio home insurance costs $969 per annum, 19% cheaper than the average national cost. This is good news for homeowners looking to save money while still maintaining adequate coverage.

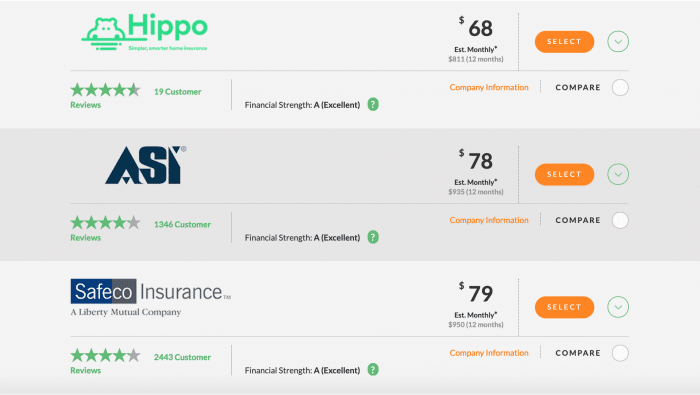

The best way to find a cheap homeowners insurance policy is to shop around and compare rates from a variety of insurers. You will find the right insurance for your budget and requirements, while also finding the best company to protect you.

You can lower your costs by looking for discounts and comparing rates. You can also look for discounts that may help lower your costs.

It is important to compare rates and choose the lowest-cost insurance provider if it's your first home. You may be able to take advantage of an early signing discount or a claim-free discount that will help you get a better rate.

Consider the additional cost for home insurance, including coverage against floods or earthquakes. These policies can be purchased from most insurance companies at a fair price and provide peace ofmind in case your home is damaged because of a natural disaster.

The question "How much is home insurance in Ohio?" is asked by many homeowners. The answer depends on a number of factors. This includes your credit record, where and how you built your home.

Credit score is also a factor in the cost of homeowner's insurance. Most companies check credit scores before they issue a policy. You should be prepared to pay more if you have a bad credit history.

Another important factor is the age and condition of your home. It is often more expensive to replace or repair older homes due to their increased vulnerability to fire and weather damage.

In this case, buying a home built with modern materials can make repairs easier and more affordable. A home insurance policy should cover your home from liability claims, such as slander and libel.

Last but not least, make sure you purchase a plan that includes a house security system. It is a popular option for home insurance policies, and can protect you against burglary, theft, or fire.

You should also choose a policy with a high deductible to help reduce your home insurance rates. A $500 deductible can save you $147 annually on your home insurance.

If you want to get the cheapest homeowners' insurance in Ohio compare rates from various insurance companies. Search for a company offering a range of coverage and with excellent customer service ratings.